This article was originally published by WisdomTree on 23 October 2025. Written by Dovile Silenskyte.

Key Takeaways

- In 2025, the US dollar is losing its dominance as Fed rate cuts, rising fiscal deficits and central bank reserve diversification weaken demand for the USD.

- Despite lingering risks like European political instability and US growth surprises, shifting into the euro can help hedge dollar-heavy portfolios and align with an increasingly multipolar currency regime.

- WisdomTree’s currency ETPs offer targeted exposure, making it easier for investors to position for potential euro outperformance in a fading dollar environment.

For decades, the US dollar (USD) reigned supreme, anchoring trade, investment and acting as the ultimate safe haven. But in 2025, cracks in that dominance are widening. With US rates falling, fiscal deficits climbing and central banks quietly diversifying reserves, the dollar looks less invincible.

For investors, that means one thing: relying less on USD and tilting towards the euro (EUR) could help balance risks and capture opportunities. WisdomTree’s exchange-traded products (ETPs) make that shift straightforward.

Why the US dollar is weakening in 2025

The US dollar’s strength has long rested on two pillars: higher US interest rates and trust in US financial stability. Both are eroding:

- Fed rate cuts: the US Federal Reserve (the Fed) began cutting in 2025, shrinking the yield premium that once attracted global capital.

- Ballooning deficits: Washington is running a near 7% budget gap1 while importing far more than it exports. Financing these ‘twin deficits’ depends on foreign inflows that look less certain.

- Diversification underway: central banks are trimming dollar reserves, rotating into different currencies and gold.

The US dollar is not collapsing, but the forces that made it unrivalled are fading.

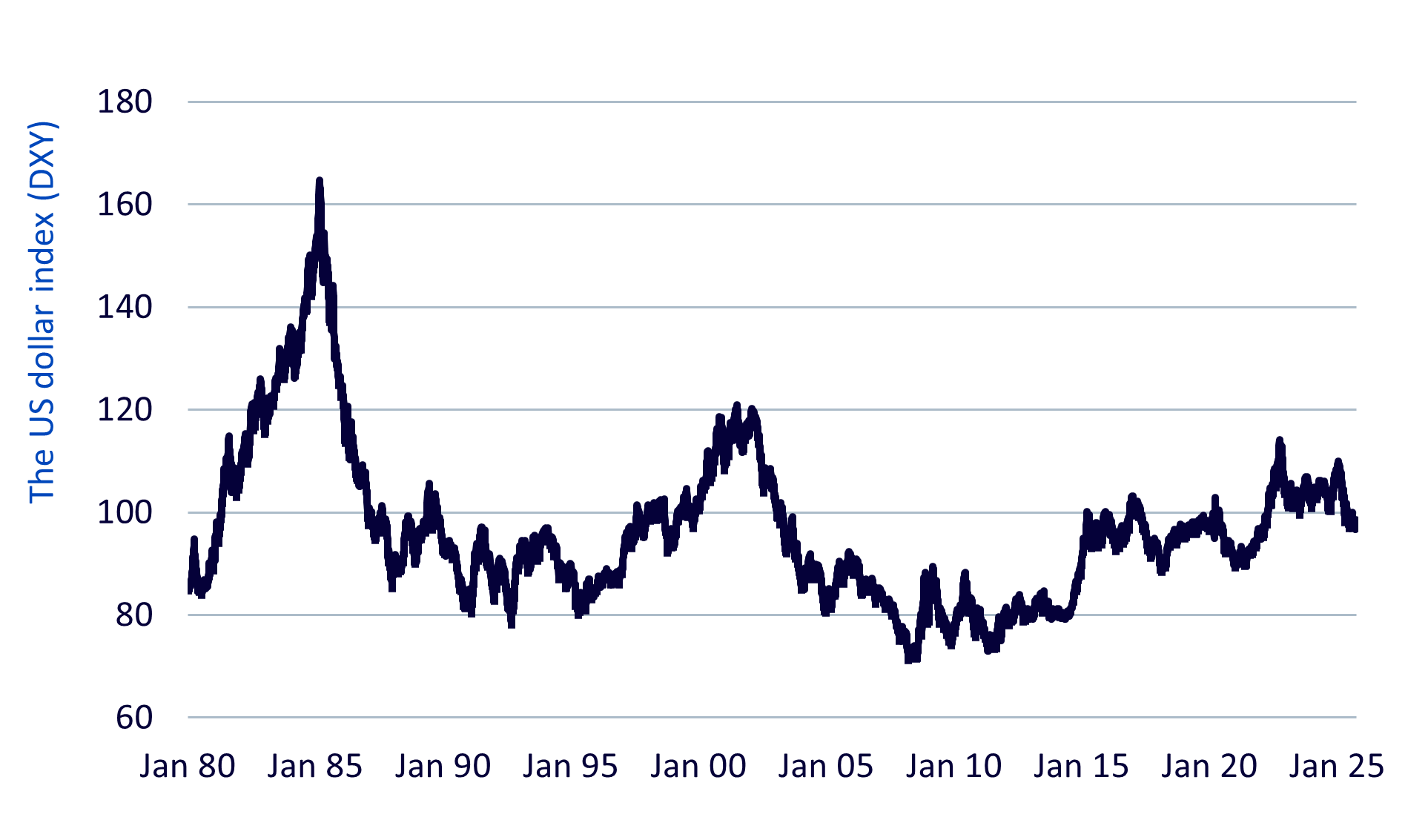

Figure 1: The US dollar index (DXY)

The US dollar’s extraordinary strength in the early 1980s reflected a rare policy mix:

- After the inflation shocks of the 1970s, the Fed under Paul Volcker drove interest rates sharply higher, creating an outsized yield premium that attracted global capital.

- At the same time, fiscal expansion under Reagan’s administration lifted growth expectations and reinforced demand for the USD.

Together, these forces pushed the dollar index (DXY) to record highs, peaking above 160 in 1985, before coordinated intervention through the Plaza Accord set the stage for a reversal.

Today, the backdrop looks almost the opposite:

- The Fed is cutting rates and eroding the yield advantage that once favoured the dollar.

- Rather than inspiring confidence, persistent deficits and worsening debt dynamics are undermining trust in the US fiscal stability.

- Instead of capital rushing into the US, central banks are gradually diversifying reserves into different currencies and gold.

The forces that once propelled the dollar higher are now pushing in the opposite direction.

A closer look at the DXY and EUR/USD

Created in 1973, the US Dollar Index (DXY) measures USD strength against six currencies, with the euro carrying the heaviest weight (57.6%2). This makes EUR/USD the most influential driver of DXY trends.

Historically, EUR/USD has reflected diverging Fed and European Central Bank (ECB) policies, swinging between parity and highs above 1.60 which was achieved in 2008. Today, it remains a key barometer of global risk sentiment and international capital flows.

Figure 2: EUR/USD exchange rate as a risk sentiment gauge

Risks investors must watch

No trend is one-way. While the euro is a compelling alternative, risks could stall its rise:

- US growth surprise: stronger gross domestic product (GDP) could revive demand for the USD.

- European politics: debt tensions in Italy or France may put pressure on the EUR.

- Global shocks: crises still tend to push investors back into the dollar’s safe haven.

Recognising these risks is essential. They do not negate the case for diversification, but instead remind investors that currency markets rarely move in straight lines. For investors, the practical question is how to balance these uncertainties while positioning portfolios for the US dollar’s shifting role.

What this means for portfolios

The message is clear: investors should avoid putting all their chips on the dollar. The global currency order is not collapsing, but it is evolving and portfolios anchored solely on USD strength may carry unnecessary concentration risk. A strategic tilt towards the euro can provide both balance and opportunity.

Allocating part of USD exposure into EUR can:

- Hedge US fiscal and monetary risks: Fed rate cuts and widening deficits erode the US dollar’s premium. Euro exposure helps cushion portfolios against these headwinds.

- Diversify dollar-heavy portfolios: incorporating another leading reserve currency reduces reliance on the USD and better reflects today’s multi-polar foreign exchange environment.

- Capture relative euro strength: from ECB policy divergence to capital inflows, periods of EUR outperformance can deliver asymmetric upside.

- Increase flexibility across regimes: euro allocations add optionality, balancing the US dollar’s safe-haven role with cyclical growth exposure.

WisdomTree’s currency exchange-traded products (ETPs) make this shift simple, allowing investors to adapt with precision to a changing currency landscape.

Beyond these, investors can also consider currency-hedged share classes of their existing holdings or opt for hedged versions of products aligned with their desired exposures, offering additional flexibility in managing foreign exchange risk.

Final take

The dollar will not disappear, but its era of unquestioned supremacy is fading. In 2025, the euro offers one of the cleanest ways to position for this shift.

For investors considering portfolio positioning for the next phase of global markets, taking a short USD / long EUR stance may present a potential opportunity.

1Source: Congressional Budget Office. The Long-Term Budget Outlook: 2025 to 2055.

2Source: ICE. June 2015.

The information on mexem.com is for general informational purposes only. It should not be regarded as investment advice. Investing in stocks involves risk. A stock's past performance is not a reliable indicator of its future performance. Always consult a financial advisor or trusted sources before making any investment decisions.

Read the original article on WisdomTree.